Since announcing in May that the LAQC regime was going to be the subject of an overhaul, the property investment community has been anxiously awaiting the Government's follow-up to the Issues Paper released at the time. On Friday 15 October 2010 draft legislation was released.

As at the time of writing all practitioners, including myself, were poring over the draft to get to grips with the new regime. The objective of this article is to provide an overview of the proposed rules.

Recap

In May, sweeping changes to tax rules were announced with the two of most significance to property investors being the prohibition on claiming depreciation on buildings after the end of the 2011 financial year and drops in personal income tax rates. At the same time, the Government announced that they wished to review the current tax rules in relation to LAQCs. In the Issues Paper it was proposed that LAQCs would be treated as limited partnerships for tax purposes with the three main consequences of this being:

- LAQC profits would be attributed to shareholders (as well as losses). Perhaps unsurprisingly, the IRD had expressed concern that the existing tax rules allow an arbitrage in that shareholders of a loss-making LAQC can offset losses against their personal income where the tax rate has historically been as high as 39%, whereas they could hold shares in a profit-making LAQC and have the profit taxed at the lower company tax rate (historically 33%, now 30% and moving to 28% from 1 April 2011).

- Losses able to be claimed by shareholders to be limited to the shareholder's "investment" in the LAQC. Broadly speaking, this was proposed to include capital of the company, together with retained profit and any company debt guaranteed by the shareholders. Shareholder loans were not included and many submissions were subsequently fielded on this point. The objective here was to limit the ability of the shareholders to claim losses that exceed their economic exposure to the activities of the LAQC.

- Shareholders to be regarded as owning the underlying assets of the company for tax purposes. This meant that upon disposal of shares there would be a disposal of the underlying assets potentially triggering depreciation recovery or tax on any “tainted” gains through association to dealers, developers etc.

Draft Legislation

With draft legislation now available, it is clear that the Government is committed to implementing these changes. The outcome is largely as set out in the original Issues Paper, albeit that the route chosen is simultaneously more complicated, but more friendly for taxpayers.

The headline of the draft legislation could well be “LAQCs are gone”. From the 2011/2012 income year, existing LAQCs will no longer have the ability to attribute their losses to shareholders, which effectively represents the end of the LAQC regime. Before readers with LAQCs that are going to produce tax losses post 2011 throw their hands up in despair, let me introduce you to the new LTC structure.

The new LTC rules (LTC stands for “look-through company”) are essentially the same as the proposed rules in the Issues Paper released in May. In other words, an LTC is a company that will be taxed as a limited partnership. All profits and losses of an LTC will be attributed to shareholders in accordance with their shareholding interests. If losses are produced, the shareholders' ability to claim those losses and offset them against other forms of income will be restricted if the losses exceed what is known as their “membership basis”. Broadly speaking, the membership basis is as noted above with the confirmation that shareholder loans are included in the calculation. The sale of shares in an LTC will be treated as the sale of the underlying assets so that potentially issues like depreciation recovery will arise. In saying that, it is noted that there are thresholds and exceptions as to when there will be a tax cost.

Transition Options & Relief for LAQCs

On a positive note, the new rules contain extensive transitional rules that allow existing LAQCs to seamlessly transfer into the LTC regime or into an alternative limited partnership, general partnership or sole trader structure if desired, without a tax cost. This is an excellent outcome for taxpayers utilising LAQCs at present.

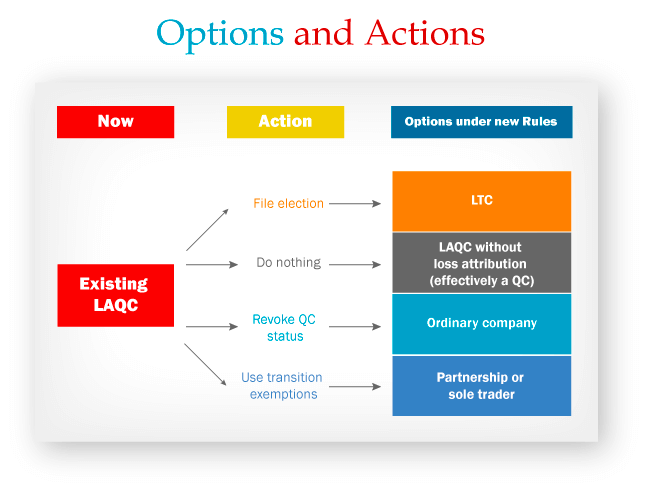

Perhaps the best way to sum this up is if you have an LAQC at present going into the 2011/2012 income year, you have four options as follows:

- Do nothing which will see your company remain an LAQC but lose the ability for the losses to be attributed to the shareholders.

- Transition into the LTC regime. Under the draft legislation you will have six months to file an election with the IRD to convert your LAQC into an LTC, which will then see it taxed as noted above.

- Take advantage of the transition provisions to restructure your LAQC into a limited partnership, partnership or sole tradership. Any such transition will not come at a tax cost, but there are restrictions as to when this is available.

- Revoke LAQC status and have the company revert to being an ordinary company.

Comment

In my view, the new rules contain no greater issues for investors that currently operate LAQCs than were raised in the original Issues Paper. It is fair to say that the introduction of the new LTC regime complicates matters in that investors will now have grapple with a new regime, but it seems likely to me that most will choose to transition their LAQCs into the LTC regime. Whilst an LTC has potential disadvantages in terms of the potential limitation of losses and the disposal of shares potentially triggering tax consequences, these potential disadvantages may not be an issue for many investors. In most cases the shareholders of an LTC will be guaranteeing the debt and therefore the shareholder's membership basis will likely always be large enough to allow full ability to claim any losses produced. The treatment of a disposal of shares as being the disposal of underlying assets is definitely an issue for those of you who have properties that have been heavily depreciated and you should seek advice as to your options prior to 31 March 2011 if you are in this situation.

In closing, I see the LTC as effectively replacing LAQCs and see them as being widely used by investors. Having said that, the transition process presents both opportunities and risks for investors and I urge you to get advice in relation to your existing LAQCs and the transition options prior to 31 March 2011. Contact Us At GRA

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Property School provided great info about subdividing and looking for sites in Auckland as well as creative cash flow techniques. - Finn T, June 2018

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More