Bearing in mind that current interest rates are around 4.5%, and many investors will take out interest-only loans, these new criteria can very quickly make a cashflow positive investor look like their cashflow is negative. Result? The bank won’t approve finance. I’ll illustrate with an example.

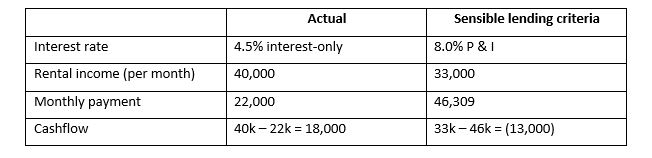

Suzanna has built a good portfolio of properties and has $6 million of debt. Her current repayments are in the ‘Actual’ column of the table below. If she were to approach the bank today, they would assess her as per the ‘Sensible lending criteria’ column.

Based on today’s reality, Suzanna has $18,000 positive cashflow, so can easily service her loans. However, using the bank’s criteria, she is backwards by $13,000, which means she fails the bank’s serviceability test and they will not lend her anything.

Even if we look at the situation when Suzanna comes off interest-only onto P & I at today’s rates, meaning her monthly payments increase to $30k, she is still ahead by $10,000.

How can investors manage in this ‘sensible lending’ environment?

There are a number of things property investors can do to be able to continue investing under these stricter rules, including:

- Arrange lines of credit with your bank now, before you need them.

- Reduce your credit card limits before applying for finance – even if you only ever use a fraction of your credit card limit and you pay your entire balance off each and every month, the banks look at the credit you have available and assume you will use all of it when they assess you. You can increase your limits later if you need to.

- Don’t apply for a new credit card until you have your lending in place.

- Make friends with your banker – if they know you and you treat them well, they will be inclined to do what they can to help you. For example, buy them a Christmas gift, take them out for coffee occasionally.

- To meet the new bank servicing requirements, many investors will need a bigger deposit, so you may want to consider working with a JV (joint venture) partner. Lots of our clients do this, and as long as you have a robust shareholders’ agreement, JVs can work very well.

Additionally, it is advisable to ensure your borrowing is structured correctly from tax efficiency and asset protection perspectives, and this is something we can help you with at GRA. You can contact us on (09) 522 7955, info@gra.co.nz or via our website.

Salesh Chand

Partner and Director of Business Services

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Fabulous advice to assist people just getting started in property investment. A wealth of knowledge packed into six 2 hour sessions which are easy to fit in to a busy working schedule. There are a lot of tips and tricks to make sense of what can be a very complicated process. I leave property school with the confidence injection I needed to go forward with a plan. - Name unpublished by request

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More