With the Government earthquake levy increasing by 60% on 1 October 2022, escalating rebuild values, and insurers adjusting their premiums, it’s a good time to check your house insurance. Here’s the low-down and some tools to help you.

In recent years we have seen significant growth in the value of housing across New Zealand. Contributing to this are the increasing costs of construction, supply constraints and labour shortages. Put simply, you now need to insure that same house for a lot more.

In addition, the levy and pricing changes will affect what most homeowners and landlords will pay for their insurance when it next renews. These changes, alongside the recent year of house price growth, mean that it's a very good time for you to ensure that you have enough insurance cover and that you are getting value for money.

Let’s break down the recent industry-wide changes:

1. Changes to Earthquake Commission cover

From 1 October 2022, all New Zealand homeowners will be affected by the Government’s Earthquake Commission (EQC) changes, which are intended to keep insurance affordable in higher seismic regions.

- EQC cover increase

The natural disaster cover you receive from the government is doubling from a cap of $172,500 to $345,000 incl. GST per dwelling. When the damage exceeds this cap, we (the insurer) pay the difference, up to your sum insured.

- EQC levy increase

For most homes, the levy is increasing from $345 to $552 incl. GST per year. Some homes will not see a full levy increase due to their insured value. The cost of your insurance includes this EQC levy, which insurers collect on behalf of EQC.

- EQC changes affect everyone from 1 October 2022

All home insurers have to implement this change. Homeowners throughout New Zealand (regardless of their insurer) will be affected when they start or renew a home insurance policy.

The new levy will be applied when your home or landlord insurance policy next renews, after 1 October 2022.

Learn more about how EQC cover works here

2. Changes to insurer premiums

As a landlord, the cost of your rental property insurance is made up of:

- Government levies (EQC, Fire & Emergency NZ);

- GST; and

- insurer premium.

The insurer premium is what insurance companies use to pay claims. This figure is calculated based on things like the location and seismic risk of your property, age of property, water supply, reinsurance costs (the insurance that insurance companies take out), and the overall cost of claims.

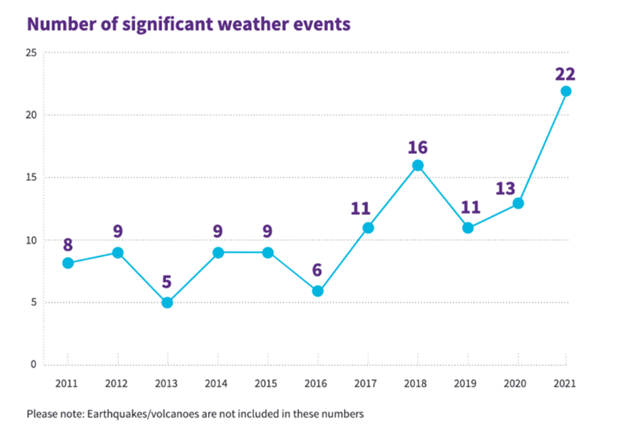

In terms of claims, 2021 saw a sharp increase in the frequency and severity of weather events, such as the flooding in Napier and Westport, and the tornado in South Auckland. And 2022 has been no different, with the recent Levin tornado and Nelson flooding, among others.

Source: IAG New Zealand Wild Weather Tracker April 2022

Contributors to rising claims costs are the double digit increases in the cost of construction, disruptions to supply chains, rising wages, and workforce shortages.

As a result, landlords and homeowners will see some significant changes in the cost of house insurance.

Compare your cover and price check your current house insurance

As well as being hit with a chunky Government levy increase, you may also see decent changes to what you pay for house insurance.

You can compare rental property insurance cover between insurers and also get an instant discounted quote with the incredibly easy tools initio have created for landlords. For a quote, you literally just need to type in the address of the property.

Initio also has tools to help you calculate the current rebuild value of the house.

More about initio

Founded in 2010, initio is a New Zealand owned, online house and landlord insurance provider. Initio provides simple, competitive insurance, and a responsive and smart approach to support and claims – with real people. Initio has spent the last 12 years enhancing its award-winning technology to keep insurance costs down.

Initio offer discounts to GRA clients – to find out more and get an instant quote click here.

Guest Contributor

Invited guest writer

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Very much enjoyed the Property Leaders day - very good event with some outstanding presenters - Andre C, May 2019

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More