Case study

Remuera vs Otara

The Great Property Debate: Cash flow vs Capital Growth

Property investor compares investment returns

Tyson is a property investor, looking at investing in the Auckland market. He has been told by his parents that he should 'buy the worst house in the best area, and only invest where he would be comfortable with having his tenants over to dinner'. (I note that some people call Tyson's parents awful snobs and say they should get out in public a bit more often.) But personal bias and snobbery aside, do Tyson's parents make a valid point? Does the quality of an area and socio-economic status of the tenants dictate returns in the Auckland market?

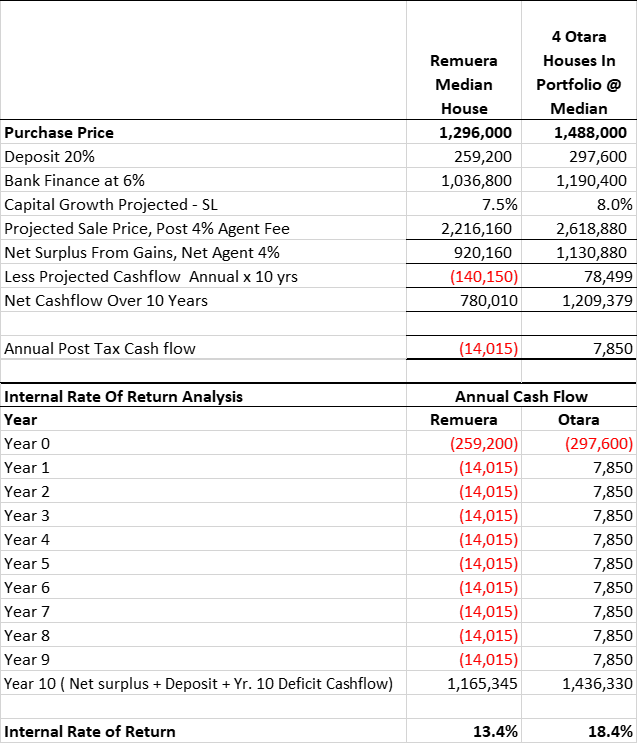

Tyson decided to test the theory and look at the maths of the 10-year return on two specific suburbs, and make his investing decisions based on numbers, not old sayings and emotion.

Otara vs Remuera

- Tyson picked Otara versus Remuera to test the theory

- He picked four-bedroom houses in Otara with permitted sleepouts, which rent at $550 per week, but he used $525 to be conservative. He picked four-bedroom houses in Remuera which seem to fetch $1020 per week for a house of circa $1.3m.

- He started looking at capital growth rates and observed that houses in Otara had a median price of $64,500 in 1992, and as at December 2014 the median was $372,000. This revealed a long-term annual straight line growth rate of 22% over that 22 year period.

- Remuera went from $271,000 to circa $1.3 million over the same timeframe, revealing a 17% straight line growth rate.

- In more recent times the 12-year growth rates were Otara 13% versus Remuera 11.6%.

- The nine-year growth rate from 2005 to 2014 reveals a more even position of Otara at 9.4% versus Remuera at 9.3% – almost the same.

- Of course cash flow also needs to be taken into account when making investment decisions, and areas like Otara tend to produce better cash flow, whereas areas like Remuera often require cash to be injected into the investment over time. So Tyson expanded to a total return analysis as follows:

- Looking at a portfolio of four houses at Otara's December 2014 median house price (but targeting houses with permitted sleepouts) versus one house in Remuera at its December 2014 median

- Using Otara growth at a more conservative 8% and Remuera scaled back to 7.5%, being numbers Tyson is comfortable with as he believes growth rates will decline over time.

Tyson was interested that Otara, with its higher cash flow but similar capital growth, won the contest on total return. He wanted further convincing so looked at the five-year and two-year comparative growth rates to see if the shorter term trends were changing. This revealed as follows:

22-year: Otara was doing 22% vs Remuera 17%

9-year: Otara was doing 9.4% vs Remuera 9.3%

5-year: Otara was doing 12.2% vs Remuera 10.5%

2-year: Otara was doing 22.3% vs Remuera 12.5%

Source Property Ventures Real Estate / REINZ Median House Price Data

Otara is still standing up.

From an internal rate of return (IRR) perspective, selling at year 10, this is how it stacks up:

Comprehensively then, looking at the total return and IRR, Otara keeps up with Remuera's capital growth, but thrashes it when cash yield is added into the analysis.

Author notes & morals of the story

- Contrary to intuition, Otara is in fact higher growth than Remuera.

- Buy the 'worst house in the best area' is an old, outdated saying that does not work very well in Auckland when it comes to investment property. 'Do I want the tenant to come to dinner?' is also not a very smart property buying strategy.

- In this made-up case study, Otara is meant to represent many of Auckland's cash flow suburbs. Remuera represents stereotyped capital growth suburbs. My point is, the growth differential between 'quality growth suburbs' and 'cash flow suburbs' in Auckland is a bit if a myth. In my experience, the so-called 'low growth, high cash flow suburbs' are in fact high growth, high cash flow suburbs, and outperform the prime capital growth suburbs on total return.

- Some investors will be able to find cash flow in the prime capital growth areas – I accept that and I do it myself. But it is much harder to do than in the so-called 'cash flow suburbs', where cash flow is everywhere and you still get high growth. My Otara projection is arguably low – I routinely beat this in South Auckland as far as cash flow goes.

- You could argue that picking Otara houses with sleepouts introduces selection bias in the projection, because the rents are slightly higher than the norm. However, in my view, informed investors targeting cash flow are entitled to pick the better cash flow houses in the cash flow areas, as part of their investment assumptions. If you are a cash flow investor, you buy the cash flow asset, not the median/average return. I hope that makes sense.

- No doubt readers will be concerned about vacancy and potential repairs and maintenance from rougher tenants in the cash flow suburbs. In reply:

- Renovations: In my experience, if you adapt the standards of the renovation to the suburb, you can keep your costs down, i.e. don't put Remuera tradespeople and fit-outs into South Auckland, and control your costs.

- Vacancy: It is very easy to get a tenant anywhere in Auckland, and has been for at least the last decade.

- The argument against cash flow suburbs (concern over potential vacancy rates eroding returns) may be valid out of Auckland, in areas that do not have a deficit housing supply.

- In Auckland I have never had a problem getting a tenant in cash flow suburbs like Otara, Manurewa and the like. The deficit housing supply makes obtaining a tenant very quick.

Summary

I am not saying, 'Here is a silver bullet, go buy in South Auckland for cash flow and high growth and this should be your only property strategy'. Far from it. I'm simply pointing out to those that 'want to be able to have their tenants to dinner', that there are other places you can invest in Auckland, and do very well, possibly even better than in the perceived prime residential suburbs.

If you'd like to learn more about property investment strategies, you might be interested in attending one of our upcoming events.

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

I would like to express my gratitude for taking the time to meet with me today. It's always a pleasure to connect with a knowledgeable and talented consultant like yourself. Our conversation was truly enjoyable, and the overview you provided was exactly what I've been looking for.

- CH, August 2023

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More