As part of the Government’s property policy announcements today (23 March 2021), there are two significant changes to tax rules that will impact residential property investors.

If you don't support the changes, there is a petition that you can sign (link here and at the end of this blog).

I ran a webinar discussing these changes on 25 March. You can watch the recording here.

Extension of the bright-line period

Currently the bright-line period for residential property is five years. For residential properties acquired on or after 27 March 2021 that period will increase to 10 years. There is a significant exception to this rule for 'new builds', which will continue to be subject to a 5-year period. There is not a lot of detail on what a 'new build' is, although the suggestion is that it will include properties that are acquired within a year of the Code Compliance Certificate being issued.

A key question here is what constitutes 'acquisition', which is critical for determining if the 5 or 10 year rule applies. Acquisition occurs when there is a binding sale and purchase agreement in place. Thus if your agreement is dated prior to 27 March 2021, then the 5-year rule applies. If the agreement is dated on or after 27 March 2021 then the 10-year rule will apply.

An immediate point for readers to be aware of is that if you are considering restructuring the ownership of an existing property then you need to have a binding agreement in place to sell it into the new entity before 27 March 2021, if you want the new entity to be subject to the 5-year bright-line rule rather than 10-year rule.

There is also a change to the main home exemption. Previously you got this if you lived in the home for most (i.e. more than 50%) of the time that you owned property. Under the new 10-year rule, you only get to claim the main home exemption in full if you have lived in the property 100% of the time. If the property has been used as your home for part of the time and as a rental for part of the time, then the gain that arises on sale is apportioned across the relative uses and you pay tax based on the proportion of the time that it was not your home.

No interest deductions

This is a more significant change for investors and was not signalled by the Government.

From 1 October 2021 there are going to be restrictions on residential property investors’ ability to claim interest as a deductible expense. For properties that are not new builds and acquired on or after 27 March 2021, you will not be able to claim any interest deductions at all.

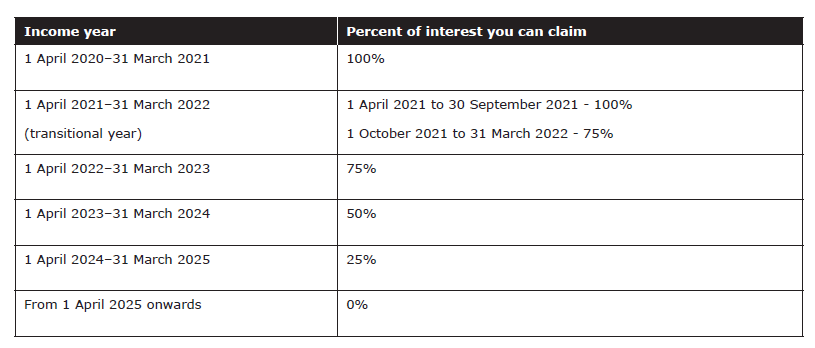

For second-hand properties acquired prior to 27 March 2021 your ability to claim interest will be phased out over the next four income years, so that from 1 April 2025 there will be no ability to claim any interest as a deductible expense against residential rental income. The phase-in period over four years sees interest become progressively less deductible over each financial year as depicted in the following grid:

New build exemption on interest

Interest incurred on a 'new build' that is bought for investment purposes is exempt from this, i.e. interest deductions can still be claimed where you buy a new build as a rental. The question is though, what 'new builds' qualify for such exemption? This is yet to be clarified and the Government have given themselves up to 1 October 2021 to work out what this definition is. They have said they will consult as part of the process.

Interest incurred by property dealers and developers, is not impacted by this change, i.e. still deductible. Obviously, property dealers and developers pay income tax on profit realised when the property is sold.

Under current rules, which have been in place for decades, you get to deduct interest against rents - 1/3 of interest is therefore tax offset. With no tax offset between interest and rent, you now pay effectively 33%-39% of the interest not deducted. (Assuming you are paying tax at 33%-39%.)

For instance, if you previously received $32,000 in rent and paid $5,000 in rates, insurance and repairs, and $27,000 in interest, you had net cashflow of zero. Now you will have to pay tax on $27,000, due to interest not being deductible. So net cashflow will become negative $9,000 due to the new tax rules, when previously it would be zero. (At 33% tax).

Illustration of phasing in of interest deduction changes

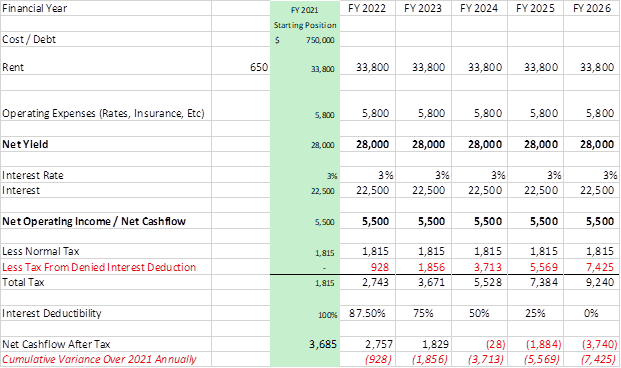

Have a look at the table below which shows how these changes will affect an investor as they are phased in over four years. In this example, the investor has a $750k property, with $750k of debt at an interest rate of 3%.

While $7,425 does not sound like a lot to many, it is to the household that is likely spending every dollar they earn maintaining their own home and the rental property they purchased as an investment. Typically, average Kiwis own these houses, not rich oligarchs.

My thoughts

I can see the social equity argument in bright-line rules, but there can also be legitimate reasons to have to sell a property. Over 10 years a certain proportion of New Zealanders will suffer from some disaster or shock, such as a divorce or a medical health issue or financial crisis of some sort - a legitimate change of circumstances, but now they are going to be subjected to this tax. I think five years captured the speculators; we didn't need to extend to 10 years. But I can live with 10 year bright-line rules for the most part.

What I strongly disagree with are the interest deductibility rules. These are an ambush set upon middle New Zealand without consultation and against Treasury advice.

I am also very concerned that the PM, having had a referendum, said she would go back to the polls for permission for further tax reform. Robertson said he would not touch bright-line or other tax measures in the 2020 October election. Within five months of being elected on these very policies, this Government broke their promise and brought in one of the biggest tax changes I have seen. The change is squarely hitting middle New Zealand in their wallet, a middle New Zealand I note that voted them in on their word that they would not do this.

I want to be clear am not totally against this Labour Government. They have done some very positive things so far – the infrastructure fund and the Resource Management Act focus are both very positive, and Labour’s leadership during Covid was great. But I am very concerned that they are not being true to their word here. How do you trust them after they break their promise so significantly, over such a short timeframe?

I am fervently against these interest deductibility rules, which I consider to be an attack on middle income Kiwis. Because the top end of investors (i.e. the very wealthy) have no debt, or can repurpose residential debt over business income, they will not have to pay tax on non-deductible debt. This leaves ordinary Kiwis trying to provide for themselves by investing in an already difficult NZ housing market (including Healthy Homes costs, loss ring-fencing rules and new tenancy rules) now facing the additional burden of effectively 1% of their total debt as a tax. That's not fair, when the Government promised no tax reform without going back to the polls. Crocodile tears says the Greens. Actually, hard-working Kiwis' money, that will stress their households and undermine their retirement savings plans.

And for the Government to label the interest deductions a 'tax loophole enjoyed by property speculators' is insulting to the public's intelligence, and disrespectful to these hard-working Kiwis involved in the property industry. Interest is an ordinary cost of doing business, and every business in the world operates with tax deductions on interest. If you want to remove the tax deduction, I would suggest they do it without the innuendo and distraction of a PR spin.

In relation to new builds now getting interest deductions and second-hand houses do not, do landlords now dump second-hand housing, and build new houses? In the intervening period, what happens to supply of rental housing as landlords move by tax incentive to new houses? Time will tell, but this is an unnecessary and unwelcomed tax difference that will increase compliance costs and create market distortions.

It is going to take the shine off second-hand investment property, which could reduce supply for second-hand rentals due to the interest deduction rules on such houses. Many investors won't be able to afford to buy a second-hand rental property or simply wont want to, because they will effectively be paying tax on a negative cashflow.

Kainga Ora as a property developer

What is happening here is the Government are giving Kainga Ora an open chequebook, to compete against the private sector. Rather than partnering with the private sector to produce housing efficiently, the Government believe they know better and can do it better. I think that has been disproven on many occasions, not just in this Government. They can't even get their social housing stock up to Healthy Homes standard in the private sector statutory timeframe, let alone build a significant number of new houses quickly. How did that go for the Government with KiwiBuild? Have they learnt nothing from their first term?

And in relation to them having their own consenting process, what that says is they can't fix councils and the RMA, so they will make special rules for themselves. Why not fix the problem, and work with the efficient private sector? Answer: ideology.

House Prices

Will house prices fall as a result of this change? No one knows.

My pick is that there will be an initial confidence shock, and coupled with the LVRs and other regulatory changes, we will see a flattening in demand for second-hand houses from investors. But no crash. Homeowners will get a better shot at second-hand houses with investors so disadvantaged. In this regard the Government will be successful with this policy.

But new builds will be ever popular due to the tax benefit of still being able to deduct interest on them. So off the plan sales will be very popular, and likely we will see continued house price inflation on new builds and development sites. There must also be upward pressure on rents, as landlords attempt to pass the cost of the phased in tax on interest not deducted, over the next four years.

But in the immediate term, no panic, no crash, nothing to stress about is my pick.

If you cannot handle the cashflow cost of paying the tax (on interest not deducted) in years 3-4, consider selling now while the market is good. Otherwise stick to your plan, and keep investing for the long term. We could see a change of government reverse these interest rules; both Act and National are saying they will do so.

Summary

Investors do not welcome these rule changes, but at least they are phased in, so you can plan your affairs in an orderly manner over the next couple of years. If we can help you with your planning (tax, property, strategy), drop us a line and get in touch. Ph +64 9 522 7955, info@gra.co.nz or via our website.

If you'd like to watch the webinar I ran discussing these new rules, you can view the recording here.

Petition

If you, like many investors, find these new rules unfair, you can sign this petition.

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

To whom it may concern: The Corporate Trustee team at Gilligan Rowe and Associates have been our Professional Trustee for our family trust and trading trust since May 2005. From the initial advice during the designing and creation of our trust structures through to the day to day operation of the entities, the support and guidance we have had from the Corporate Trustee team has been second to none. As a business owner and operator, I need to have reliable, efficient, proactive and knowledgeable people as part of our business team and Gilligan Rowe and Associates Trustee services tick the boxes in all of these criteria. I have no hesitation in commending and recommending Gilligan Rowe and Associates Trustee Services team to anyone who requires professional and competent guidance in the safe operation of their trust and in turn secure protection of their assets. - RNT

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More