One of the things many of us do as property investors is think about the changing financial environment we invest in, and try to pick the market trend for the year coming. I think for 2020 it is an easy pick – the market is looking very buoyant and positive for property.

But property is affected by so many variables that it's often difficult to see the wood for the trees. Supply (dwelling construction rates and zoning changes), infrastructure projects stimulating demand, population growth (demand from migration patterns, net birth death rates), interest rates, money supply conditions, employment rates and business confidence, taxation trends, government change and regulation, all culminate to stimulate or undermine investor and household appetites to borrow, and purchase housing.

At a cyclical level, New Zealand peaks every 10 years with Auckland leading the pack on the '7' year. In fact, the last four cyclical peaks were 1987, 1997, 2007 and 2017 (or actually late 2016 to be precise, carrying over similar peak values into 2017). With Auckland and then the main centres peaking first, we should now be seeing them softening and the regions continuing to play catch up. This is because the more populous areas are typically a couple of years ahead of the regions in growth, leading to a ripple effect as the more expensive main centres shunt population to lower cost housing in the regions. With lag in the regions, they should have more upside in them than the main centres, which experienced growth earlier. Indeed, some parts of the regions are further back than others, making them more attractive from an affordability perspective.

For example, Christchurch to the end of 2019 is about 50% up on 2007 average values, compared to Auckland which is 96% up on its 2007 values. This means Christchurch is relatively cheaper, and in my opinion likely to benefit from ripple effect to a greater extent than, say, Dunedin, which is already 80% up. But then you also need to look at what else is going on the areas, like the potential positive effect of a new infrastructure such as the new hospital (in Dunedin) or university campus (Tauranga).

Cycles

So in 2019 heading into 2020, we should be experiencing a downturn, characterised by falling sales volumes and softening prices in Auckland and main centres. We should have increasing economic concerns and anxiousness amongst investors, if the cycle was on track following prior cycles. We should have interest rates volatile (with bankers repricing risk), declining supply with developers going broke, and investor confidence at a low. After all it's a '9' year at 2019, only two years into the down market. And in the first six months of 2019, while the main centres were slowing and there was more concern, slower auction clearance rates and volumes, you certainly wouldn't say we were in a significant downturn. More of a soft landing. But then something changed: interest rates dropped.

This time it's different

The world is awash with cash, printed by insolvent nations and central governments attempting to flood liquidity into the world, and stimulate growth and inflation in asset values. (There is nothing like a bit of inflation to rectify ailing balance sheets.) And this has been going on for a long time globally (over a decade with the US now into a fourth round of quantitative easing ), though it has taken a while to really impact NZ interest rates with supercheap credit.

In the second half of 2019, the cheap cash FINALLY came to New Zealand, with rates dropping into the low to mid 3s. For example, HSBC have been lending last quarter at 3.35% for 1 to 5-year fixed rate agreements, with most other bankers within 35 bps of this rate. And the interest rate yield curves are flat, with most economists predicting things will stay that way for 10 years.

The impact of higher capital adequacy ratios (requiring main bank lenders to hold 18% instead of 10% tier 1 capital) is a remaining question mark, as banks transition the capital held on their balance sheets. These changes are progressive over seven years commencing July 2020, so the impact should be slow and spread out, not a knee jerk reaction from banks to shunt rates up. But time will tell on this point, with crocodile tears flooding from the big banks at the prospect of having to raise more cash to do the same amount of business in NZ. Of course this issue has no impact on non-bank lenders, who compete with the main banks, but don't have to comply with the Reserve Bank rules. This should give them an advantage, and ultimately curtail the prospect of main banks passing the full cost on to borrowers, as borrowers will simply flock to non-bank lenders if the main banks get too greedy with interest rate rises.

Talk to our broker, Kris Pedersen HERE if you would like to meet a non-bank lender.

Boomers Chasing Yield

Baby boomers are wealthy (compared to their descendants), but are having to change their investing patterns. No longer are they getting yield from fixed interest investments. They have to do something different, and chasing yield in the stock market and property markets is where they (and institutional investors) must head.

Cash yield from declining interest rates

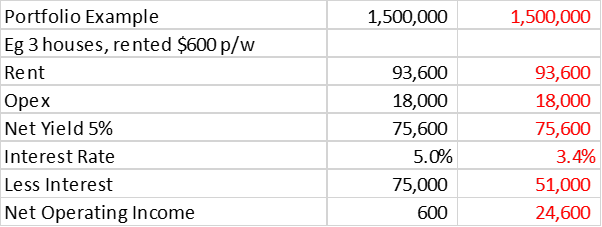

Consider the effect of a drop in rates from say 5% in 2018 to 3.5% at the end of 2019 on $1.5m borrowed and invested in property, at a net yield (rent less operating expenses) of 5%. The table below compares the two results on the net operating income, after interest cost.

The same amount invested now generates $20,000 more to the investor off the bank leverage alone. If the investor puts a 30% deposit on the investment, they make even more from the return on the deposit put into the property at 5%, over the alternative of bank interest return at say 3%.

This will encourage cashed up investors to spend more and more on leveraged financial assets like property, and some shares. Inevitably this must push asset values up, as investors chase yield and accept lower returns over time. But will it ultimately culminate in a crash, or is this the new status quo? I would say the former – there will be a day of reckoning for sure; it's when, not if. But that doesn't mean we can't make hay while the sun is shining.

2020

Generally the biggest short-term determinant of property demand is interest rates and availability of credit (debt servicing and LVR testing rates). And in the second half of 2019, rates have plummeted 33% in NZ, and the testing rates have also softened in borrowers' favour. All things being equal, property prices should go up, despite cyclically being overdue for, shall I say, a continued correction in NZ. So that's my view, which changed in the second half of 2019 as rates fell aggressively. Investor confidence has returned, and demand for residential investment and home ownership is surging.

Next year we have the American election in November 2020, and a strong chance of a second term of Trump. Brexit is locked in with the Johnson Government's landslide victory. A trade war – China v Trump. A number of geopolitical hotspots like Hong Kong. We must keep in mind that disruptive global changes have the ability to create random events that could affect banking, and then the game changes instantly. But all things being equal, it seems 2020 is looking good for property in NZ, and I will continue my own optimistic participation in property markets.What am I doing in 2020?

1. Buying in the regions, because they are cyclically behind and more likely to get growth.

2. Trading houses, in various JVs across NZ, a continuation of my 2019 strategy. I like trading in rising markets to de-risk my investment, so I will continue to do this in the regions. For example, I have 14 trades in Christchurch at present. And four in Central North Island. I trade because it generates cashflow, reduces debt (as I use the taxed surpluses to pay off loans). This also allows me to make money without inflating my balance sheet – you can't keep it all.

3. Developing in Auckland, I built nine houses in 2019. Sell some, keep some – the develop to hold tax concessions in NZ are brilliant. And the Auckland Unitary Plan is creating some excellent development opportunities up here, and I intend to continue doing this.

4. Targeting cashflow property in Auckland and the regions to hold, with social housing tenants. The net operating income coming of some of my investments as a result of lower interest rates and robust tenancy arrangements, is creating fantastic yields.

I use a lot of my own investments as examples for my investor clients to follow and copy. Our philosophy at GRA is, look at what we do, copy what we do, get what we get. It's the benefit of being one of our clients; we share information rather than hiding it like it's a national secret. At the end of the day, there is plenty to go around in property, so it's our pleasure to share the information with clients.

What Should You Do?

What your household does practically speaking with planning for your property future needs to be bespoke to your household. Every household has different conditions, goals, ages, risk appetites, cashflow and equity levels. There is no 'one approach fits all' advice.

We run workshops at GRA (including our complimentary introductory Property Information Seminars), where I present and discuss what I am doing to make money in this environment. But unlike others offering tactical (how to do it) advice, like 'this is how you trade', we try to extend to what strategy is right for you, based on context of your household's capabilities. For example, if you are buying a first home, first rental, first development, first trade – how does the borrowing work and therefore should you be doing it? What skills and time allocation do you need? Is there a better strategy more appropriate for your household's circumstances? Once you get that right, then hit the strategy detail, which we are very strong on at GRA because all of our property mentors, accountants and people are active investors. For example, at the close of 2019, I am involved in 61 property investments ranging from developments to trades, long-term holds and social housing, and include both commercial to residential. I particularly focus on social housing at present for the long-term holds, and Auckland for development.

If this sort of thinking and open discussion fits with your mindset, you may well enjoy attending our Property School in 2020. Or benefit from spending time with our property mentors, run by GRA's subsidiary, NZ Property Mentors. We offer face-to-face bespoke assistance with clever investors in the market. We have an amazing resource in our Wealth Suite property portal, full of investor resources, education and tools. Get in touch if you are interested at our helpdesk and speak to Maggie on +64 9 522 7922, or attend our complimentary introductory Property Information Seminar for a good starting point.

Merry Christmas

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Property School showed me what I can do now and what I can aspire to - lots of options regardless of your position. I really liked the practical examples. - VM, June 2018

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More