As property tax and structuring specialists, one of the most common questions we encounter at GRA is whether to set up a look-through company (LTC) to hold investment property. The answer, more often than not, has shifted over the years to no.

LTCs, once considered a go-to option for property investors, have seen their appeal diminish significantly in recent years. Let's delve into the reasons for this shift and what alternatives are now on the table.

The Decline of LTCs: Legislative Changes and Impact

Historically, LTCs were favoured for providing a unique situation where limited liability protection can be achieved with the added benefit of tax transparency, allowing profits, losses, and gains to flow through to shareholders. This setup was particularly beneficial pre-2019, where a high-income earner could offset rental property losses against their employment income, maximising tax refunds. However, several legislative changes have reshaped this landscape.

1. Loss Ring-Fencing: Implemented from 1 April 2019, this rule prevents property investors from offsetting rental losses against other income sources like employment, thus preventing a tax refund. This policy was specifically targeted at property investors and pinches their pocket as it affects cashflow.

2. Property Interest Limitation Rules: Applied from 1 October 2021, interest deductibility on residential rental mortgages was phased out, with exemptions for social housing and new builds. This further eroded the financial advantages of using LTCs for property investment, as it caused accounting losses to turn into artificial tax profits. Whilst the National-Act-NZ First coalition government has reversed these rules completely from 1 April 2025, there is aways a risk that they will return if/when Labour return to power.

3. Increase in Top Marginal Tax Rate: The introduction of a 39% tax rate on individuals who earn over NZ$180,000 from 1 April 2021 compounded the impact of denied interest deductions where the highest income earner was the majority shareholder of the LTC (previous gold standard), making LTCs less favourable for high-income earners.

The Impact on Investment Strategies

These legislative shifts have effectively flipped LTCs from being a favoured structure that provides asset protection and the ability to utilise rental losses to receive tax refunds, to potentially a structure that results in taxpayers paying tax at the highest rate of 39%.

Example

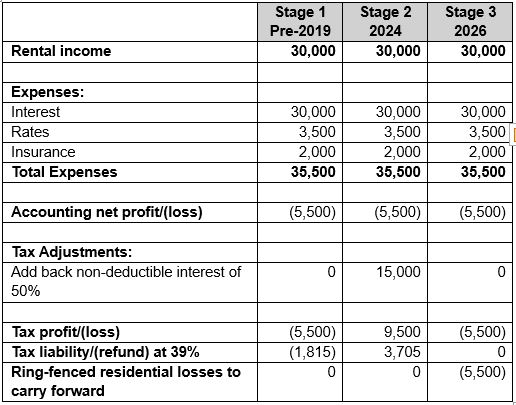

Below is a simple illustration of how these rules apply in practice. The example has been applied in three stages, assumes all parameters remain equal, and that the shareholder of the LTC is subject to tax at the highest marginal tax rates that applied at that time.

As you can see, very different outcomes are reached despite the same inputs:

- Stage 1 results in a tax refund of $1,815

- Stage 2 results in tax to pay of $3,705

- Stage 3 results in ring-fenced tax deductions to carry forward with no refund/tax liability

Given the diminished appeal of LTCs, investors are now considering alternative structures.

Alternatives: Companies and Trusts

The main alternatives to and LTC are “ordinary” companies and trusts. When considering structuring options, it is important to be mindful that there is no such thing as the “perfect structure”. However, a better structure will still exist over the alternatives.

Structuring is complicated and needs to go beyond your current situation if the structure is to be versatile and cater to future needs/changes. This requires a wider understanding of your goals and ambitions, understanding the pros and cons of different entities, and choosing a structure that, all things considered, provides the best outcome.

Considerations When Choosing Between Trusts and Companies

Trusts

Pros: Provide asset protection, estate planning benefits, and potential tax advantages through income splitting among beneficiaries, as well as enhanced privacy given there is no trust register (unlike companies with the Companies Office).

Cons: Higher setup and maintenance costs, and 39% tax rate on trust income not split to beneficiaries.

Companies

Pros: Offer limited liability protection, clear ownership structure, and potential tax efficiencies with a corporate tax rate of 28%.

Cons: Public disclosure requirements, less privacy. Can be more difficult to access capital gains post sale.

Conclusion

Deciding whether to use a trust, a company, or an LTC to hold rental property in New Zealand depends on your specific financial goals, risk tolerance, and the current legislative environment.

While LTCs have lost their lustre due to recent tax changes, trusts and companies offer viable alternatives with their own sets of advantages and disadvantages.

Before making a decision, it's crucial to seek professional advice from tax and legal experts who can assess your individual circumstances and recommend the most suitable structure. By carefully weighing the pros and cons of each option, you can ensure that your investment is structured optimally to meet your long-term financial and personal objectives.

Investing in property is a significant financial commitment, and choosing the right ownership structure is essential for maximising returns and minimising risks in the ever-evolving regulatory landscape of New Zealand's property market.

For help with identifying the right ownership structure for your property investment activities, contact us at GRA by phoning 09 522 7955, emailing info@gra.co.nz, or filling out our online form.

Quade Fraser

Client Services Manager

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Thank you for the incredibly detailed assessment of the improvement discrepancies, all the considerations and the suggested course of action. You've made everything understandable and clear.

In all a good result, thank you very much for all your involvement Maggie, you've been wonderful to work with and certainly made my first home buying rodeo a lot smoother than it might otherwise have been!

Thanks again, I wouldn't be making such informed decisions without you!

- Ben Tong, November 2020

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More