They take effect from 1 July 2017 onwards and are targeted at reducing the income tax deductions that residential property investors can claim on travel expenses and depreciation of assets used in these properties.

Who is affected?

The changes impact the majority of people who own residential rental property in Australia (whether they live in Australia or not), including individuals, self-managed superannuation funds (SMSF), and most trusts and partnerships.

The restriction does not apply to:

• Companies

• Super funds (other than SMSF)

• Public unit trusts

• Managed investment trusts, or

• Unit trusts and partnerships comprised exclusively of these excluded entities.

Travel deductions

Travel expenses previously allowed in relation to inspecting, maintaining or collecting rent for a residential property cannot be claimed from 1 July 2017 onwards. These amendments are also designed to catch travel costs associated with the purchase or sale of the property.

Further, the amendments cover capital gains tax (CGT), in that travel expenses that have been made non-deductible will also be excluded from the cost base of the rental property for CGT purposes.

Travel includes motor vehicle expenses, taxis, airfares and any meals & accommodation costs associated with the travel.

Depreciation of assets

For second-hand residential premises purchased, property investors can no longer claim depreciation on previously used plant & equipment. This means that depreciation cannot be claimed on floor coverings, air conditioning, appliances etc. within the property at purchase. This takes effect on residential rental properties purchased on or after 7.30pm on 9 May 2017.

However, there is a trading stock exclusion. In many cases the property investor is not the first owner of the depreciable asset, as they have acquired it from a property developer or builder as an asset installed during construction, or they purchased it from a retailer such as Bunnings, e.g. a stove. As such, the depreciable asset is trading stock and is excluded from the amendment.

Impact on those that are affected

In a nutshell, the deduction for depreciation will be reduced for those who are affected by this rule change. Further, there will also be an impact where the assets are subsequently sold. This is technical in nature but can impact the balancing adjustment for the sale of the asset, and it also has an impact on CGT.

The numbers tell the story

Let’s illustrate the effect of the new rules with a case study.

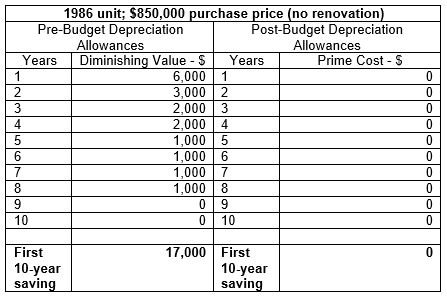

Darren and Lisa purchase a unit that was built in 1986 and pay $850,000 for it. They do not undertake any renovations. Before the amendments to tax deduction rules, they could have saved $6,000 in the first year of ownership, and $17,000 over 10 years.

Under the new rules, however, the depreciation deductions they are entitled to come to a grand total of zero. The table below demonstrates this difference between the pre-budget and post-budget depreciation claims.

Summary

If you own residential rental property in Australia, the amendments to the tax deduction rules will apply to you and will impact upon your after-tax cash flow. If you have concerns about this, please get in touch with us at info@gra.co.nz, via our website, or by phoning +64 9 522 7955.

Comments

Testimonials

We are looking forward to working with GRA and giving our financial affairs the due diligence they deserve. It was such a pleasure meeting with GRA on Tuesday. Thankyou for spending so much time with us. We appreciated and respected the advice that you gave to us and the integrity with which it was delivered. Many thanks and kind regards - AR - July 2017

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More