Albert Einstein said "If I had an hour to find a solution, I'd spend 55 minutes thinking about the problem and 5 minutes thinking about solutions."

It's a pity those that suggest the introduction of a capital gains tax as a solution to remedying the Auckland housing shortage, don't practice this sentiment. Surely the more time we spend trying to understand the very nature of the problem, the greater the likelihood of effective solutions being posited.

Historically the suggested capital gains tax is nothing new. I wrote about capital gains tax in August 2014 when Labour proposed it. At that time, the suggested implementation evoked such an emotive response that we lost sight of the actual issue that was purportedly being addressed and started instead, to argue over the proposed antidote.

Now is no different. If what you read in Google land is anything to go by, the Auckland housing shortage has turned into cries of "first home buyers can't buy homes", "house prices are rising too quickly", "people are making tax free money out of housing" and "Kiwis are diluting the economy of much needed fuel by investing in property rather than other things". All of these headlines do nothing to address the issue. Rather, the problem becomes lost in the midst, sidelined almost, to the point where sensible workable solutions are overlooked.

Other than advocating a capital gain made on a property is properly taxed, alternative answers have been put forth to alleviate the Auckland housing shortage. A quick search of the world wide web will tell you if we choose to stop all immigration, permit newly migrated people to our shores to purchase only new homes built off the plans, prohibit all residential purchases by non-residents and foreign investors entirely or require all borrowers to have at least a 20% equity stake in the homes they are purchasing, the problem will be solved. Unfortunately, simple answers to complex problems rarely work.

Auckland's housing shortage predates the GFC. As availability of credit decreased during those economically challenging years, correspondingly so did the supply of new housing. Despite the global financial crisis having ended, the housing supply-demand dilemma continues to the point where there is now a reported 20,000 house shortage occurring in Auckland, although that number does depend upon how you define 'shortage'.

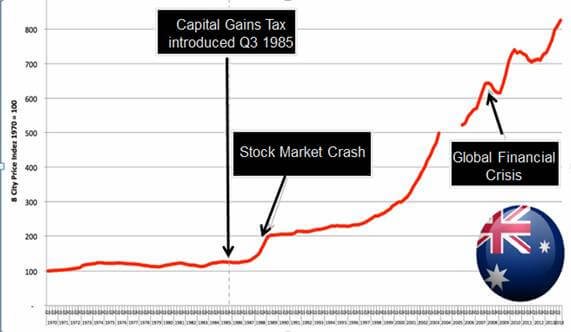

Herald the posited capital gains tax idea. According to some, this will redress the supply-demand dilemma and result in a much wanted solution. Before discarding any purported answer, it's important to test its viability and we can do that with respect to capital gains tax by looking at historical events and other countries. A quick look back frequently assists in developing a long look forward. Simultaneously, we need to be mindful that history cannot act as a cast iron precursor of future events. Australia introduced capital gains tax in 1985. For those interested in property, the graph below depicts a story. When the tax was introduced, property owners took a breath and declined to list their properties for sale. This resulted in a decreasing of available housing. When property owners finally succumbed to placing their properties on the market, they simply priced in the tax they calculated they'd have to return to the Revenue. Accordingly, property prices rose.

Reviewing our nearest neighbour's data, it seems fair to summarise that simply applying a tax to a capital gain in property, does not assist the housing issue. Rather, it could well act to exacerbate the problem. The effects more probable to be experienced are short run (3 years or less) less houses will come to market, vendors when they finally list their homes for sale will demand higher prices to take account of the tax they must pay the IRD, and because supply is short, the desired sales price will be achieved. Neither supply nor affordability will be assisted with effects like this being felt. Consequences I think will be even higher market sales prices set, with sales being made to only those who already have a stake in the property market and/or those with reasonably sizable cash deposits.

Perhaps a more multi-dimensional solution than the application of a capital gains tax is required to an issue which at the very heart, isn't merely a supply-demand imbalance in housing. It's much more multi-facet than that.

I can think of several different issues which all interrelate and contribute to the Auckland housing shortage. Whilst I'm not an expert in this arena, it seems sensible to me to address these, as by doing so, the wheels of progress should start turning towards remedying the problems encountered.

|

ISSUE |

CONSIDERATIONS |

|

Land Availability + Developers Incentivised |

Land needs to be freed up to enable the building of homes. Developers need to be incentivised to do the building via margins they stand to make for the risk they incur. |

|

Review Council Processes |

Cut the red tape. Ensure the process of applying and receiving appropriate permits and consents is timely. This will assist in getting developments out of the ground. |

|

Amend Legislation |

A rationalisation of the Resource Management Act will help enormously with development and building processes. |

|

Set New Council Fees |

Cut the fees. This will help margins and induce developers to build the much needed houses. |

|

Redress Material Monopoly |

Implement an improved system, encourage innovation and permit use of building materials that are sound and are more affordable. Overall this should increase competition and hopefully decrease prices down. |

|

Encourage Training |

You can't build homes without builders and associated trades. People need to be encouraged to train and enter the building sector. Supply of labour is imperative if we are to address the problem. |

|

Implement Infrastructure |

Services need to be implemented in the areas the houses will be built in. This requires Council co-operation as well as companies to complete the work. |

I'm sure there are those more qualified to judge than me, but my research has shown clearly that implementing a new taxation policy in itself won't address the issue Auckland is facing. Several pivotal parties with answers to the multitude of interrelated problems Auckland faces need to come together to find solutions to overcome the dwelling shortage. The difference between successfully solving this issue will lie in applying a multi-pronged approach emanating from a diverse group of people. Hopefully, along the way, issues such as housing affordability will also be solved, ultimately making Auckland an even more desired abode.

The Professional Trustee Team

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

I got a lot out of each Property School session and feel I have a lot more knowledge. - Amelia, September 2018

Property 101by Matthew Gilligan

Investing in residential property?

Put this at the top of your reading list.

If you're investing in residential property, seeking to maximise your ability to succeed and minimise risk, then this is a 'must read'.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s viewpoint. Written in easy to understand language and including many case studies, Matthew explains the ins and outs of successful property investment.

- How to find the right property

- How to negotiate successfully

- Renovation do's & don'ts

- Property management

- Case studies and examples

- and much, much more...