To briefly summarise some basics, the purchase and sale of property as part of an ongoing activity of property dealing, development or erecting buildings (i.e. acquisition for sale) is subject to GST. This means in the ordinary course of events, a property purchased for dealing purposes generates a GST claim on purchase and GST payable on sale. In this ordinary course of events, a purchaser bases the price they are willing to pay on the presumption that they can claim GST, or adjusts for it.

Zero Rating Issues

However, the catch is that the ability to claim GST on purchase hinges on the GST status of the vendor. If the vendor is not registered for GST in relation to the sale of the property, then a GST claim is available. On the other hand, if the vendor is GST registered in relation to the property being sold, then the purchase transaction is “zero-rated” from a GST perspective. This means GST applies at a rate of 0% and no GST can be claimed.

Example

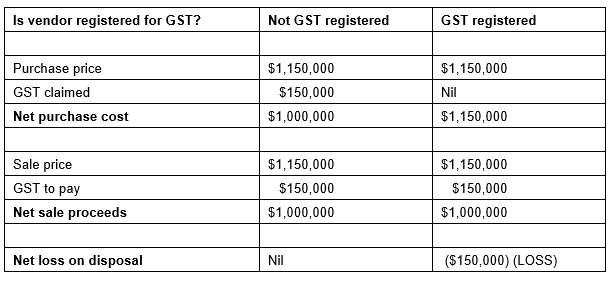

To illustrate the significance of this using some simple numbers, let's assume a scenario of a property dealer signing up to buy a property for $1.15m “including GST” and then subsequently selling it for the same amount. They assume that because the contract says “including GST” that they can claim the GST. Turns out the vendor is GST registered, which deems zero rating and denies the purchaser the ability to claim GST.

As you can see, a property purchased for $1.15 m and sold for $1.15m loses the purchaser $150,000 due to the misunderstanding over GST. Therefore, investors who are dealing with property with a GST claim at stake need to pay special attention to this issue. Advice should be sought in writing from your professionals regarding this. I say in writing because you may need to hold your professional to account if they get this matter wrong.

Extending from this, at GRA we guide our clients to include specific terms in the sale and purchase agreement to preserve the purchaser's rights to sue the vendor, should their stated GST status turn out to be incorrect.

Status can be wrong for a number of reasons.

• The vendor makes a mistake, or lies about their status to gain an advantage.

• The vendor does not state their status and you assume they are not registered.

• IRD interfere when the purchaser claims and retrospectively deem the vendor to be registered, which can be very unfair to the purchaser.

IRD Interfering with Vendor GST Status Retrospectively

This is a real hazard for investors. IRD are increasingly looking at GST claims and investigating the vendor's circumstances. The risk here is that a transaction that you thought was undertaken with a non-registered vendor, ends up retrospectively being a transaction with a deemed GST registered vendor due to investigation by the IRD. This leaves you as a purchaser out of pocket for the GST that you cannot claim, and having to sue the vendor.

Given the costs of recovery and the difficulty in holding companies and their directors to account, this again speaks to the importance of making sure that sale and purchase agreements are drafted in such a manner as to preserve your rights. We advocate clauses and allow you to pursue not only the vendor, but also individuals if the vendor is a company. We provide these clauses to our clients on request, as it encourages transparency on the vendor's part and draws the issue to their attention.

Mortgagee Sales

This issue is further complicated if the property is bought as a mortgagee sale. For the most part, the default GST law is that mortgagee sales are subject to GST (even if the defaulting mortgagor themselves is not GST registered). However, if the bank can determine that the defaulting mortgagor is not GST registered, then they can apply an exception to the default rule and sell on a 'non-registered basis'.

Summary

If you find yourself on the wrong end of this GST hook, then contact us at GRA on +64 9 522 7955 or via our website.

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

We had the good fortune of attending the Property School this year and it was worth every cent of our investment. All the sessions were jam packed with useful information and We thoroughly enjoyed every minute of our time here. Matt, Janet and John all have a different style of teaching yet I'm really impressed with the depth of knowledge each of them possesses. What you will learn here is a combination of theories and practical knowledge that you can take advantage of straightaway and apply in the real world. Give them a call today and book for the next session! - JL & XY - December 2017

Property 101by Matthew Gilligan

Investing in residential property?

Put this at the top of your reading list.

If you're investing in residential property, seeking to maximise your ability to succeed and minimise risk, then this is a 'must read'.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s viewpoint. Written in easy to understand language and including many case studies, Matthew explains the ins and outs of successful property investment.

- How to find the right property

- How to negotiate successfully

- Renovation do's & don'ts

- Property management

- Case studies and examples

- and much, much more...